Natural gas prices can fluctuate

The commodity rate is the Gas Consumption Charge on your bill. SaskEnergy follows the regulatory standard practice to recover the cost of natural gas sold to customers without any markup. As a utility, we should not incur a profit or a loss on the sale of natural gas.

As natural gas prices fluctuate, the cost of buying natural gas each month varies. Because we don't know the total cost of gas for a particular period of time, SaskEnergy uses a Gas Cost Variance Account (GCVA) to balance the changes in costs and revenues over time. This approach helps provide you with stable rates over the short term.

SaskEnergy’s process is to set a rate that considers the forward natural gas market and to reduce the GCVA balance to zero over that same period of time. The rate is established for November 1st of each year. It's then reviewed for April 1st and adjusted if the GCVA continues to be too large or if market conditions change.

SaskEnergy’s rates are monitored and reviewed by independent auditors, on behalf of the Provincial Auditor, as well as the Saskatchewan Rate Review Panel.

Gas Cost Variance Account

The GCVA shows the difference between the commodity sales revenue and actual gas costs each month. Over the long term, customers pay the exact cost of acquiring the natural gas supply.

- When the actual cost of natural gas exceeds the amount charged, customers owe a balance to SaskEnergy.

- When the actual cost of natural gas is less than the amount charged, SaskEnergy owes the balance to customers.

- The GCVA balance is refunded or collected from customers in the next commodity rate application.

Natural Gas Pricing

SaskEnergy purchases natural gas on the open market. The price of natural gas depends on supply, demand, weather and pricing relationships.

New York Mercantile Exchange (NYMEX)

The primary pricing point of natural gas in North America is Henry Hub in Louisiana. Because of its connections to high consuming regions in the United States, a futures contract based on Henry Hub trades on the NYMEX and is the most quoted natural gas price in the media.

Alberta Energy Company (AECO)

AECO is the largest natural gas hub in Canada. AECO is priced as a basis (differential) to NYMEX. The basis represents regional differences in supply and demand and considers the cost to transport gas from western Canada to the east.

When a large volume of transactions occur at a hub, such as AECO, it becomes a pricing reference point for smaller hubs such as Saskatchewan. SaskEnergy purchases the majority of our natural gas from AECO.

TransGas Energy Pool (TEP)

SaskEnergy purchases 30% of its natural gas supply from producers in Saskatchewan. Natural gas is exchanged at TEP and the pricing is quoted as a basis (differential) to AECO prices.

Natural gas can be purchased in Saskatchewan from the TEP market, gas producers, marketing agencies or other end users. In addition to the “raw” cost of the commodity, the cost of gas includes the effect of natural gas price risk management transactions, administrative costs of acquiring the gas, transporting gas to TEP and financing of gas inventory in storage.

Currency Conversion

NYMEX natural gas is quoted in U.S. dollars and is bought and sold in millions of British Thermal Units (MMBtu). Gas purchases in Canada must be converted to Canadian dollars and to Gigajoules (GJ).

Changes in the Canada-U.S. exchange rate affect the price of natural gas in Canada. A rising Canadian dollar results in lower Canadian natural gas prices. A depreciating Canadian dollar results in higher natural gas prices.

Growth in the liquefied natural gas (LNG) market is increasing the importance of prices in Europe and Asia.

Gas Supply

Saskatchewan is a net importer of natural gas. SaskEnergy purchases approximately 70% of its natural gas from Alberta. Much of the natural gas flows to Saskatchewan through the Empress Hub at the Alberta/Saskatchewan border. From Empress, natural gas flows through to Eastern Canada and the Midwest US.

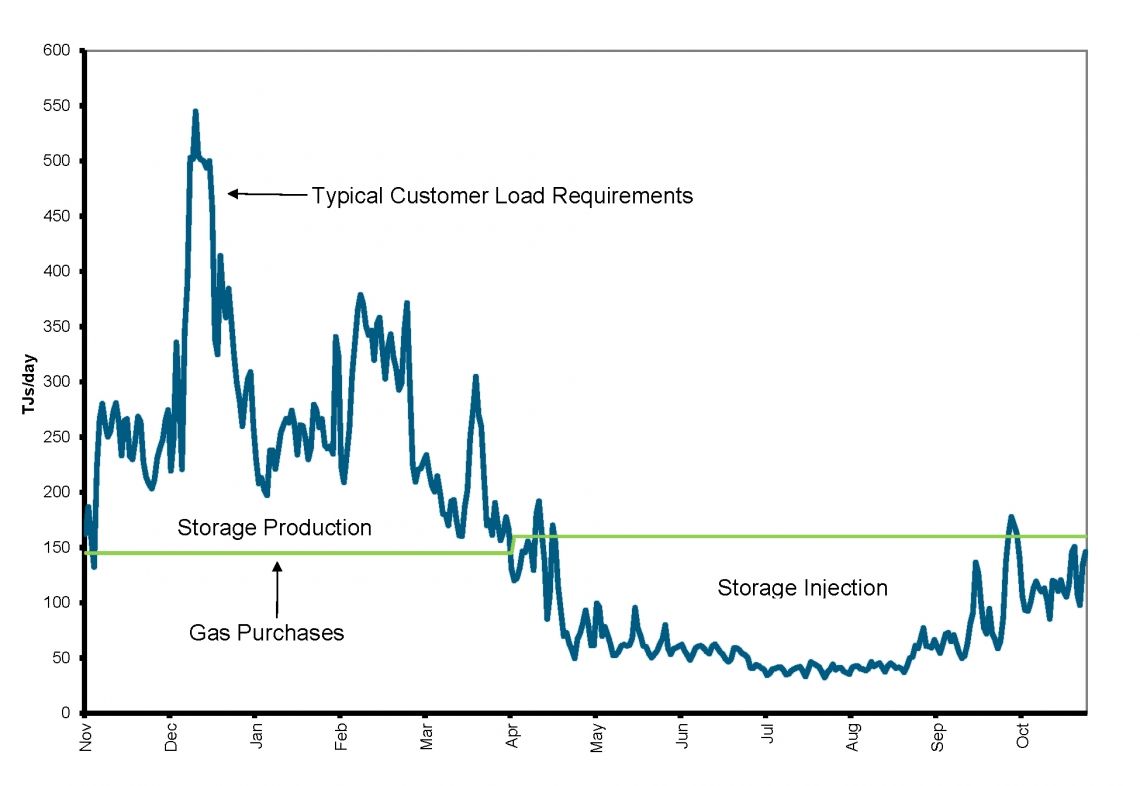

In the summer, when natural gas demand is low, excess gas is moved to storage. To meet higher heating loads during colder months, natural gas is taken from storage in addition to any daily purchases. On average, 45% of our winter requirements come from storage.

Price Risk Management Program

SaskEnergy rates contain a component of price protection to stabilize rates in a volatile market. Only a few jurisdictions currently have price protection. Utilities that don’t hedge when natural gas prices decline tend to have lower commodity rates. However, when natural gas prices begin to rise, utilities that hedge can provide price protection and offer lower rates.

In order to reduce volatility for our customers, SaskEnergy may use fixed price swaps or futures (forward) contracts to lock in the price for a portion of its' gas requirement. If natural gas prices change by the time the gas is delivered, SaskEnergy’s contracted price remains the same.

At times, SaskEnergy’s contracted price will be lower than the market price when the gas is delivered. Other times, it will be higher. The benefit of this strategy is SaskEnergy will know the price in advance – regardless of the market price. Historically, natural gas market prices have experienced changes of +/- $4.00/GJ a year.

Additional Resources and Links